Industry Use Cases

Analytics for Banking

Credit Card. Cross-sell and Upsell. Current & Savings Account. Customer KPIs.

PurpleCube for Banking

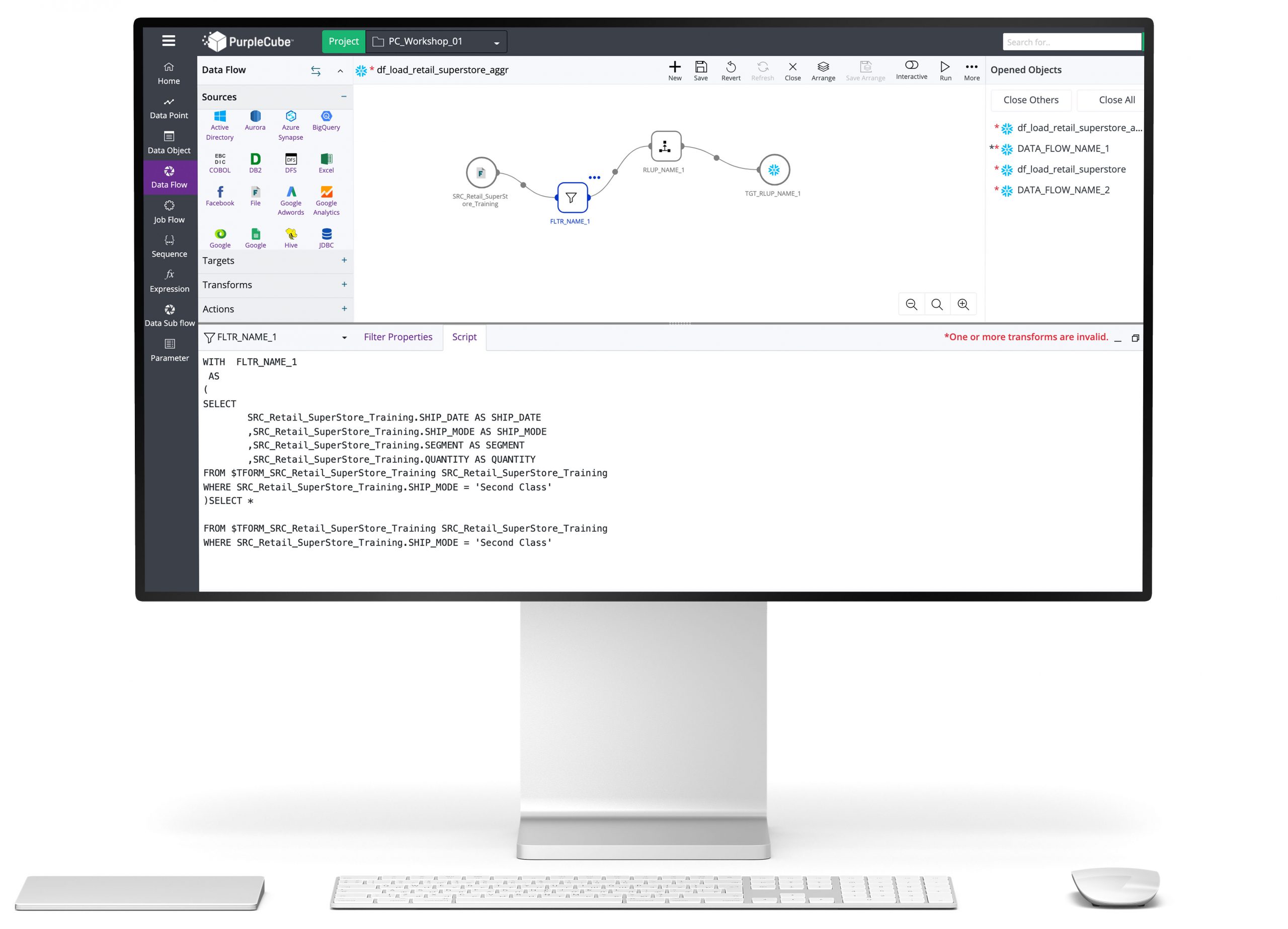

If you wish to create your own B.I. & A.I. dashboards, and have A.I. driven search capability on your data assets - then PurpleCube gives you that flexibility. You can leverage our pre-built connectors, data preparation wizard & dynamic Datawarehouse for provisioning your data sets in few clicks, at a marginal cost & without a hassle of building and managing your own data platforms.

Loans

Customer Profitability

Life Time Value

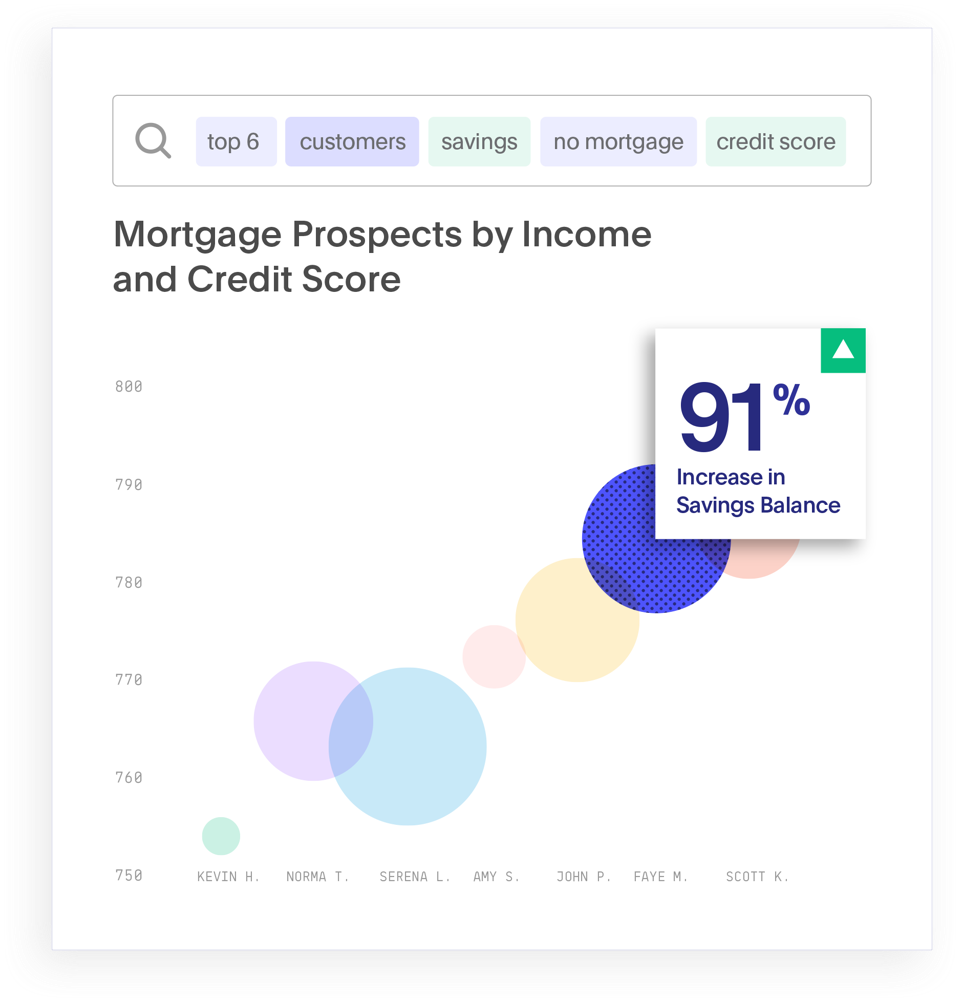

Know what your customers want. And give it to them.

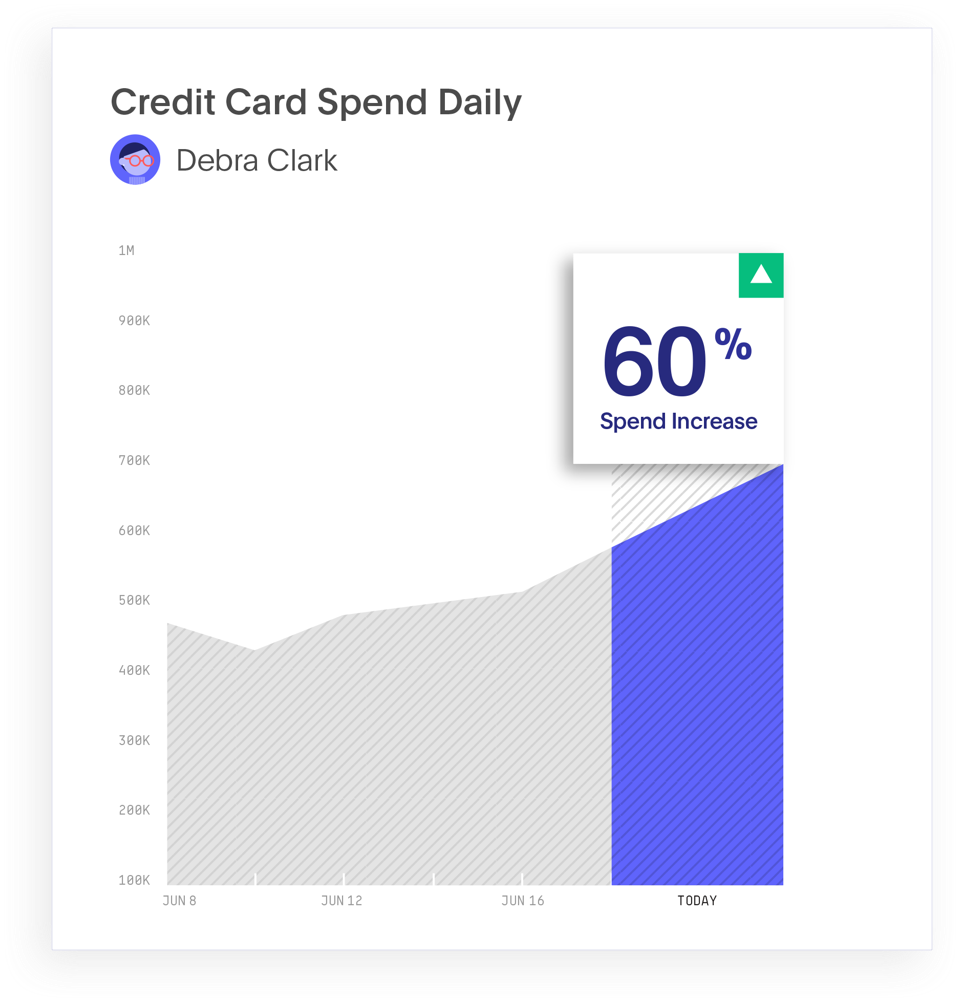

The more you know your customer, the better you can anticipate what they’ll respond to. PurpleCube’s data insights will help you discover upsell and cross-sell opportunities for specific products, services and offers.

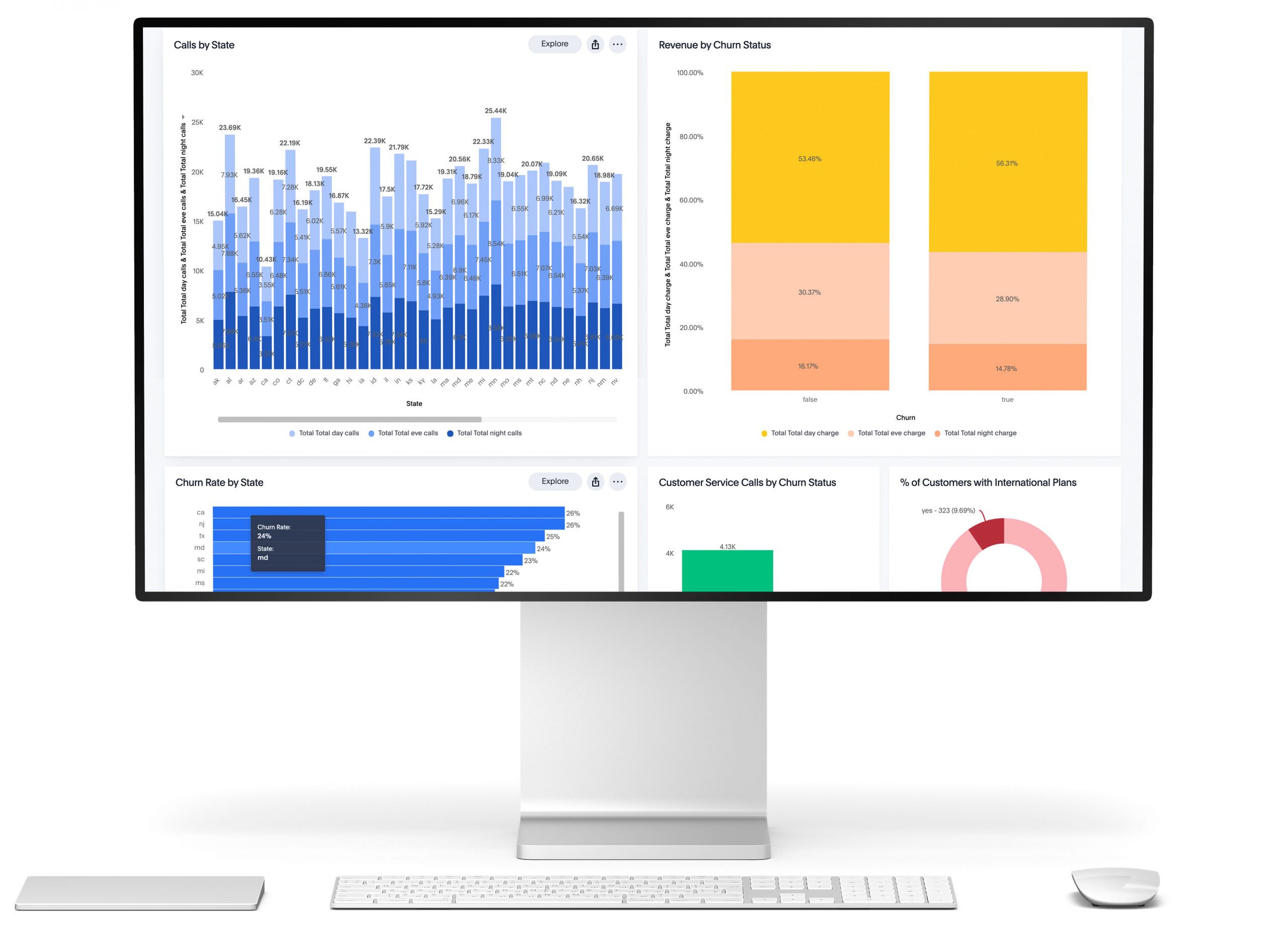

Maximize your marketing with granular insights.

Instantly identify your most successful campaigns and run smarter promotions by measuring the customer impact of every engagement and channel.

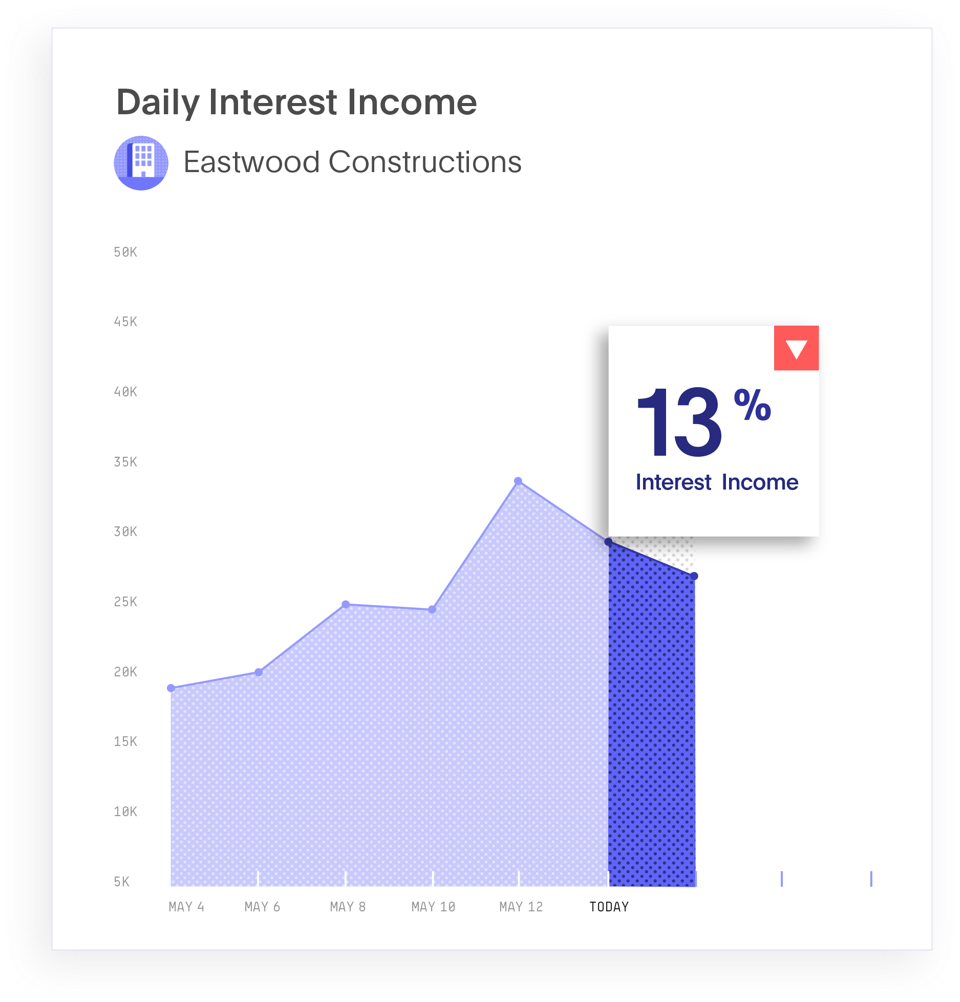

Recapture lost revenue by spotting anomalies others miss.

Small errors and miscalculations across your business can add up to serious missed revenue. Quickly identify and correct fee, interchange, and interest anomalies to maximize revenue efficiency and boost financial performance.

Ensure compliance in every corner of your company.

Get a comprehensive view of regulatory discrepancies with AI-driven insights. Understand patterns and implement safeguards throughout your organization to proactively mitigate compliance issues.

Quickly spot unusual activity and other red flags.

Use data and AI-driven insights to better understand and act upon risks banks typically face, such as unusual account activity, credit risk, information security, and market and liquidity demands.

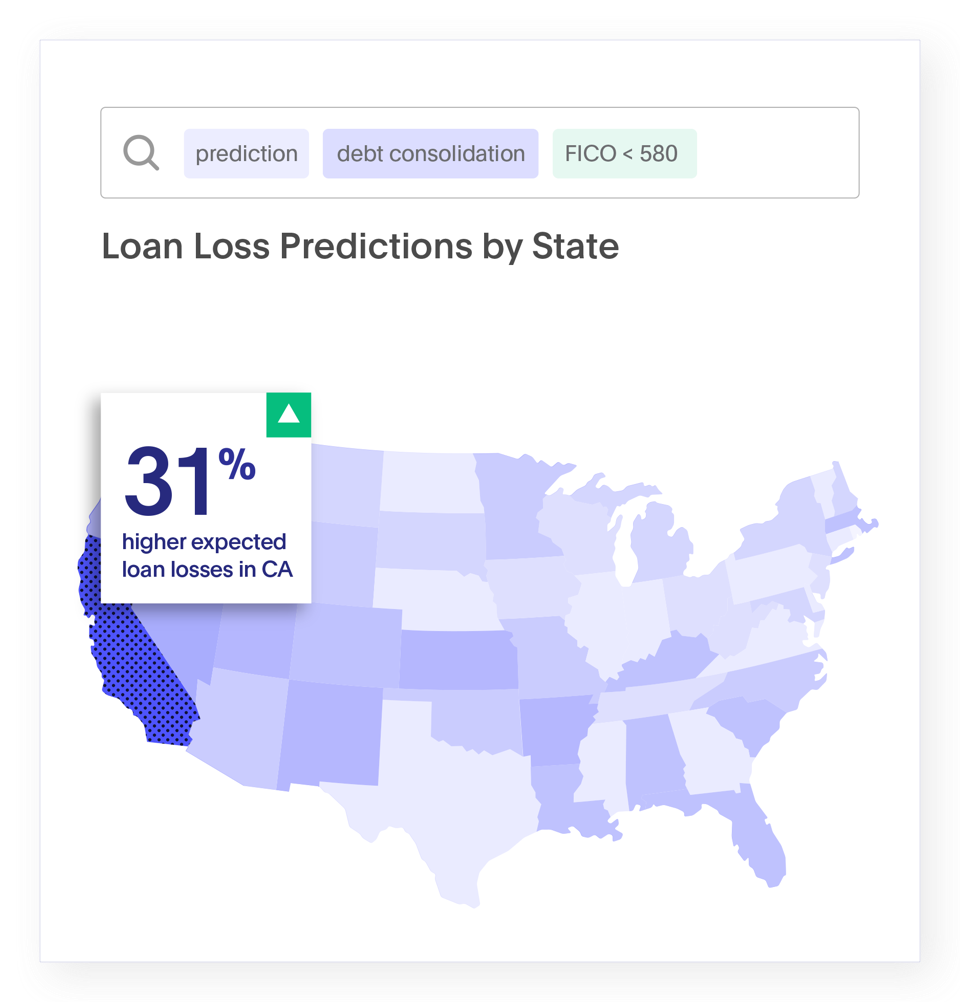

Reduce current expected credit losses with instant insights.

Empower bank personnel to quickly identify and prioritize every single at-risk borrower. Then take mitigating actions to reduce expected credit losses, thus increasing profitability and liquidity.